ICLUB Global launches an online platform for investing in startups from $10,000

Private investor club ICLUB Global launches the ICLUB Online platform, allowing anyone to invest in startups together with TA Ventures and other club members. Along with the online platform launch, the club lowers the minimum investment amount in a startup to $10,000.

ICLUB Online is a product of ICLUB Global private investors club, operating since 2018. During this time, the club members have invested in 64 startups and made five exits. The primary value remains unchanged: access to fast-growing startups from the TA Ventures fund. The platform only offers companies that have passed the fund’s due diligence and in which it has invested its money. Thanks to this approach, private investors with no experience in venture capital investments significantly reduce the risk when building their portfolios.

“The ICLUB Online platform opens up early-stage venture investments to a wide audience,” says ICLUB Global President, Founder & Managing Partner of TA Ventures Victoria Tigipko. “The time for remote investment has arrived, and we are keeping pace with this trend. On the platform, you can invest with your smartphone. It’s essentially venture capital online,” she added.

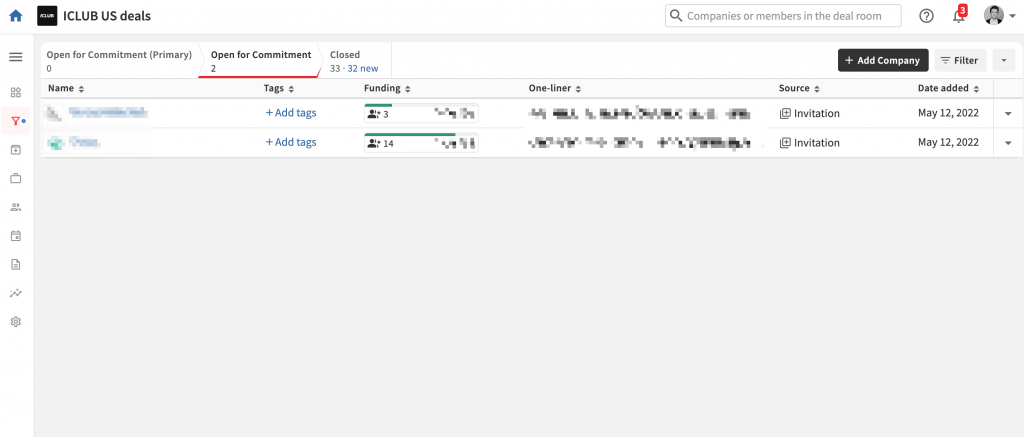

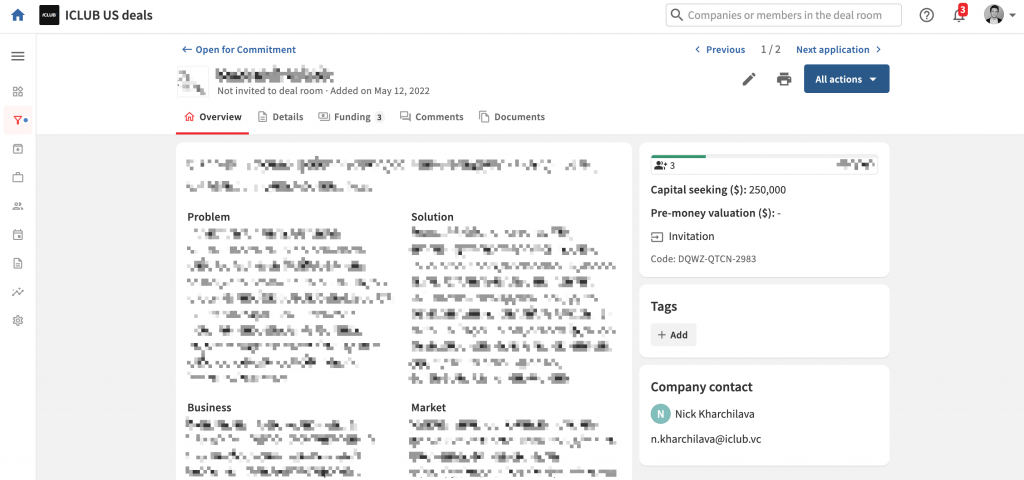

The platform’s main features are quick, convenient, and straightforward access to such a complicated process as investing in startups. The procedure consists of five steps:

Step 1. Register on the ICLUB Online website.

Step 2. After registration, a club representative will reach out to you to introduce the platform and elaborate on venture capital investments. The next step is to pass the KYC (know your customer). Access to the platform is free. The participant pays only two commissions on each investment: for management and for profit.

Step 3. The users have access to valuable materials to help them decide to invest. Foremost, this is essential information about the company, pitch deck, and records of calls with the startup team. The club offers a choice of two to four startups a month.

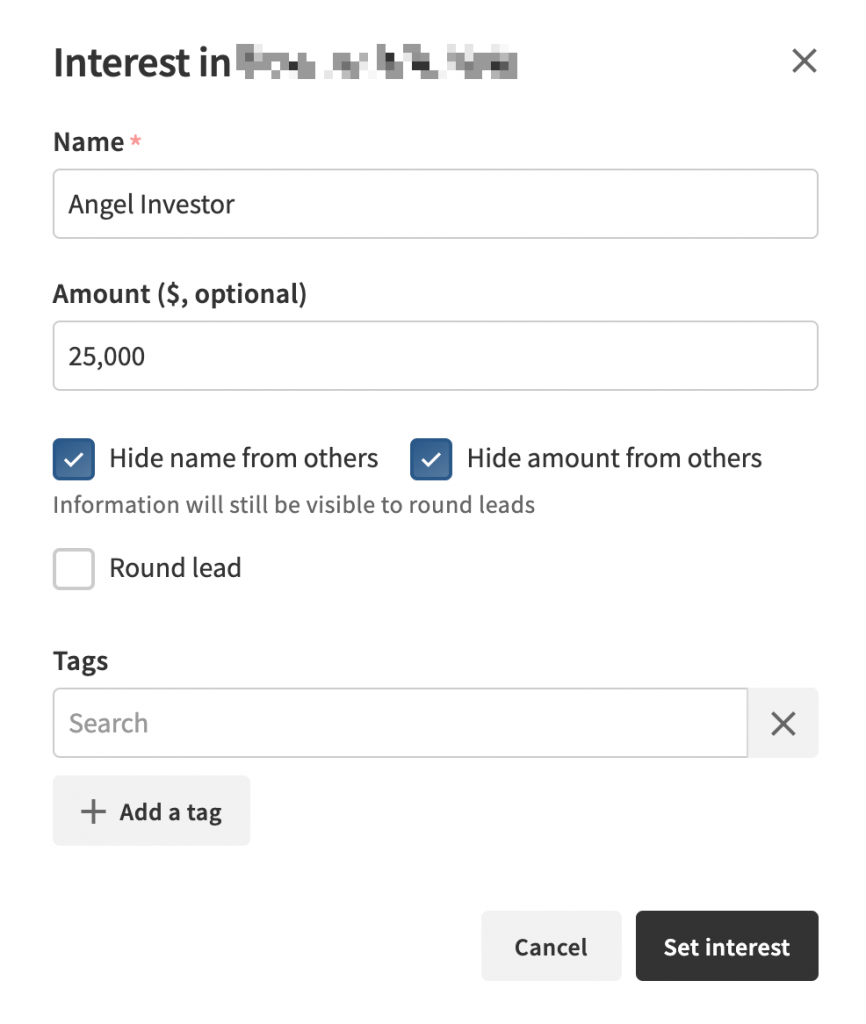

Step 4. Once you have decided to invest in a particular startup, you need to specify the amount of investment. In the end, the club’s lawyers will reach out to you to carry out the transaction.

Step 5. Club members invest and exit the deal simultaneously with TA Ventures. Investors receive quarterly reports on the companies in their portfolio until exit.

Five examples of recent exits by club members:

- Impress (Spain). Developed orthodontic technology that offers invisible aligners. Partial exit in less than a year and a half.

- Bipi (Spain). Car subscription service. It was bought by a division of Renault Group – RCI Bank and Services. Exit after 11 months.

- Finimize (UK). An information platform for investors with its own community. It was bought by Abrdn. Exit similarly in 11 months.

- Xometry (USA). Custom industrial parts market. IPO in a year and a half from the moment of investment.

- Vochi (Belarus). A video editing app. The company was bought by Pinterest less than a year after the investment.

“Investing in startups remains a secret ritual for a select few. We want to democratize venture capital investment for a wider range of stakeholders,” commented Yuri Romaniukha, CEO of ICLUB Global, during the launch. According to him, participation in the club brings another non-obvious advantage. “Startups only want to cooperate with investors who have a good reputation. They look out for you just as much as you for them. Teams won’t take money from a random person. So joining a club gives you access to deals you could never get into alone,” he added.

Venture investments are an alternative to traditional instruments such as bank deposits, bonds, stocks, or real estate. Their strength lies in their high IRR (internal rate of return). In other words, successful investors with a diversified portfolio can earn 25-30% annual returns. The disadvantages of such investments include weak liquidity and high requirements for competence in startup valuation.

Victoria Tigipko points out that TA Ventures has made more than 200 investments since 2010, including 62 exits and six IPOs. According to Cambridge Associates, this has placed them in the top quartile of funds with net returns above 25%. “We’ve minimized risk as much as possible. For experienced investors, venture capital is a good opportunity to diversify their portfolios. At the same time, startups can be a decent place to start for newcomers. There is much less unpredictability here than in cryptocurrencies and fewer capital requirements than in, for example, real estate,” she added in summing up the results.

On June 16, the club will also hold a webinar about the platform’s functionality and venture capital investments to answer participants’ questions. You may register at the same link.

Follow our Telegram Chanel